Stuart Anderson MP Supports South Shropshire Farmers Opposing Family Farm Tax

Farmers from South Shropshire were greeted by Stuart Anderson MP when they visited Parliament on Tuesday 19th November 2024 to protest against the Family Farm Tax. The policy, which will end the inheritance tax exemption on agricultural assets worth more than £1 million, is estimated to impact more than two thirds of farms - including 3,686 farm holdings in Shropshire. They joined with thousands of fellow farmers from across the country, united in their opposition in the reduction of support - which had been described as a "lifeline" to family farmers, as it allowed farms to be handed down to future generations.

The protest follows an announcement, in the 2024 Autumn Budget, that the rate of Agricultural Property Relief (APR) and Business Property Relief (BPR) will be reduced to 50% after the first £1 million on combined agricultural and business from April 2026. It means 20% inheritance tax will be charged on estates with business and agricultural assets worth more than £1 million. Analysis has found that 102,041 farms in England could be affected - a significant difference from HM Treasury’s estimate it will affect less than 500 farms a year.

Prior to the Budget, Stuart had written to the Chancellor to warn against the changes. In his letter, Stuart has said that any changes to the reliefs would be a "severe blow" to farming families and other rural businesses at a time when the government instead should be supporting them. He added that the tax reliefs ensured family farming businesses had the confidence needed to make long-term decisions, so that the next generation could carry on producing food and delivering environmental benefits after the death of a farmer.

Stuart subsequently become one of the first MPs to call out the decision after the tax hike was announced, warning that it would pose a serious risk to domestic food security and food prices - with the price for cucumbers, tomatoes, peppers, and aubergines estiminated to increase by an additional 10-20 per cent. Earlier in November, Stuart called on the government to rethink its plans ahead of April 2026 - with the change subject to primary legislation.

Stuart Anderson MP said:

"Our farmers are the backbone of our rural economy. Their high-quality produce is envied around the world and is an integral part of our food national security. So, I was delighted to welcome farmers from South Shropshire to Parliament. They joined with thousands of other farmers across the country who are united in their opposition to the Family Farm Tax, which will land farming families with an inheritance tax bill costing hundreds of thousands of pounds. I am pleased to support our farmers, having raised my concerns in Parliament when the changes were first announced. I am clear that we must help them and the other groups impacted by this cruel tax imposition."

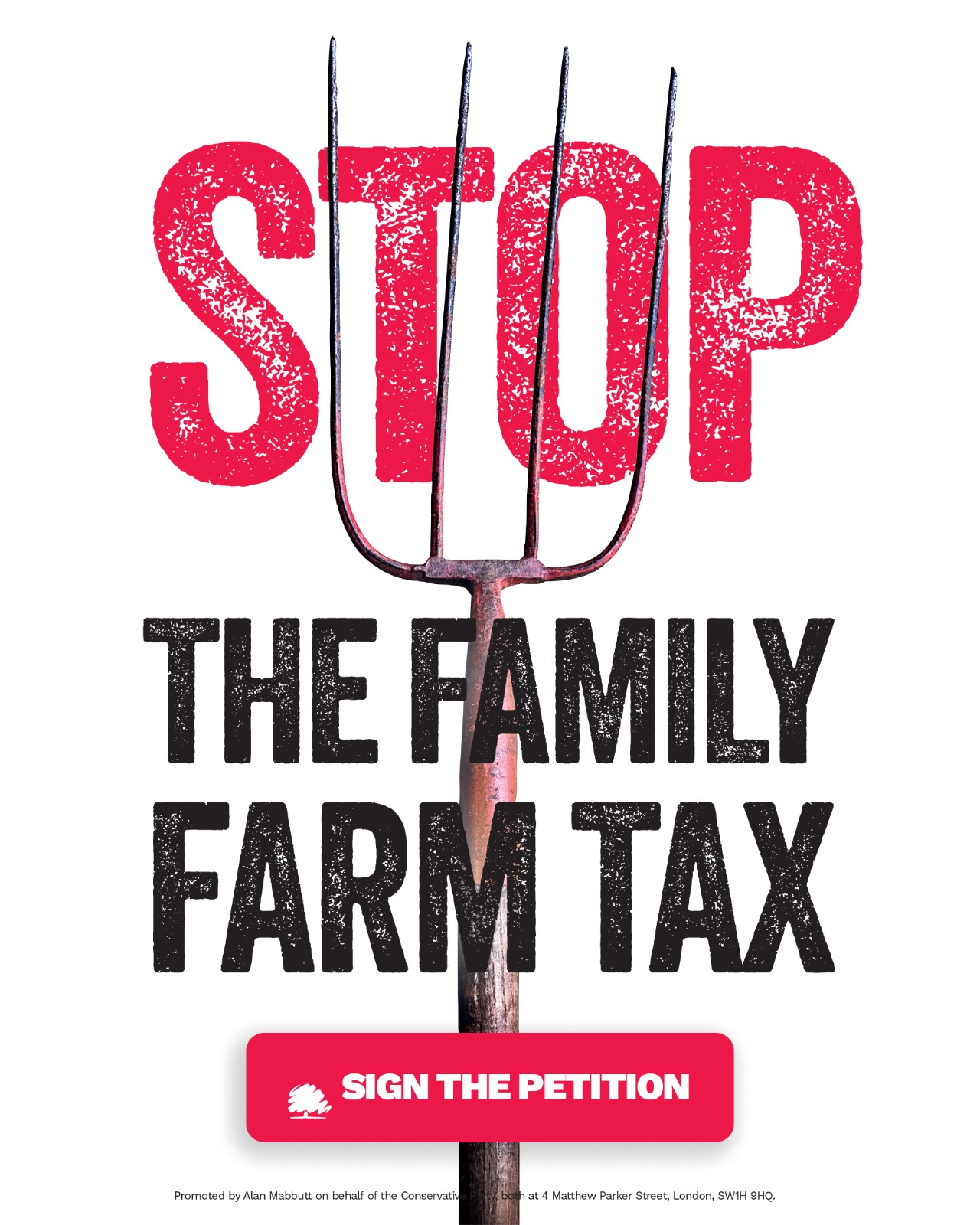

Shropshire has the highest number of farm holdings in England per county, forming nearly 20% of enterprises. A petition calling on the Government to reverse its Family Farm Tax can be found at stopthefarmtax.com. Although it has reached 100,000 signatures, we want to make it even clearer how damaging this is to family farmers and amplify their voices.